All right. I understand the Rules Have Changed, and I need to figure out a financial structure for myself. I’ve accepted that my worry about money may be out of proportion from time to time, especially when the Reptile is Ruling. But I want to separate fact from fear. What’s next?

Get the Facts. Just the facts, and only those you need. This does not mean going into a frenzy of accounting for every red cent you’ve spent over the last several months, and then going to town beating yourself up on all the unnecessary expenditures you so foolishly made. This is where most people go as soon as they hear the dreaded word “Budgeting”. Keep breathing – this is not the approach I’m suggesting.

It is important to figure out where your money is going, but not for the purposes of self-flagellation. What’s done is done. One of the most important things in tackling financial management is employing the phrase: “That was then. This is now. Next time I/we will…” That goes for anyone who is doing this on their own, and especially if they’re working as part of a couple. When you know better, you do better, and recrimination, self or otherwise, is not required or desired.

We’ve established that you can no longer count on the financial institution from which you borrow to make sure you can afford it. Those days are gone. So how do you figure out what you actually can afford?

It’s a matter of balance between three financial buckets, what Elizabeth Warren and Amelia Warren Tyagi in All Your Worth call “Must Haves”, “Savings” and “Wants”. In the past, if you were experiencing financial trouble, the culprit was usually overindulging in Wants, because no one would lend you enough to get you in too deeply on the Must Haves. Things are different now. So rather than focusing on the Wants, we’re going to start with the Must Haves. We’ll get to the Savings and Wants later.

In a nutshell, Must Haves are those items that:

• Without which you could not function on a day-to-day basis

• You would continue to pay for if you lost your job

• You are legally obligated to pay for – i.e. there is a legal contract

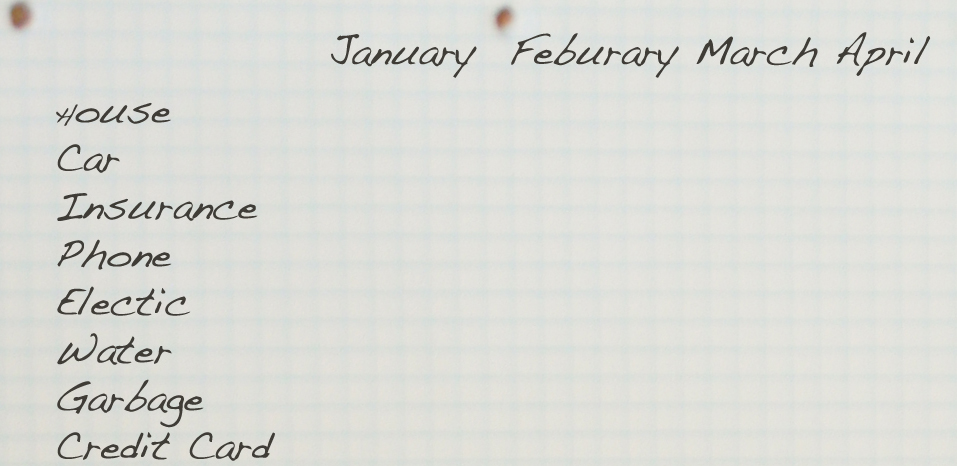

Those items include Mortgage/Rent, Food, Utilities, Basic Cable/Internet, Insurance, Property Tax, Medical Expenses, Car payments, Car insurance, Gasoline, Transportation, Insurance, Student Loans, Basic phone (cell or landline), Child Care (necessary for work), Appliance payments, Gym Memberships, etc. Oh, the boring stuff. Yup.

A special word about the Food category. In Must Haves, we are talking about BASIC food – that which you would continue to buy if you lost your job. It’s about $200 per month, per person. Think university student, not gourmet. People get funny about this when they start on this process. They add up what they spend on food, see that it’s more than the basic amount and conclude that they are “already blowing the budget, so we might as well give up on this process.” It is certainly not wrong to spend more than the basic amount; food is one of the great joys of life. It’s just that it straddles the line of two categories. The basics belong in Must Haves and the upgrades belong to another category that we’ll get to in a couple of weeks: Wants. For now, just allocate $200 per person, per month to food. Never mind what you actually spend.

Go back 3 to 6 months. If you use online banking, it should be pretty straightforward. If not, just haul out your bank statements and cancelled cheques.

While you’re at it, take note of how much you have coming in on a regular basis, too, so we can figure out what we are working with. All regular income, whether from employment, investments, child support, or whatever. Find your pay slips, the ones that show all the deductions, and gather them together. We will be using them next week.

You can do up a list, start a spreadsheet, or soon on our website, you will be able sign in and get access to a spreadsheet we’ve put together to give you a hand with that.

That’s it for this week. Get together the information on all your sources of income & deductions and all your Must Haves.

Next Week: The Rules of Money Blog #3 – Past, Present and Future